Expanding Access to International Markets

We customize a complete collection of market knowledge and data to meet your specific requirements using pricing and analytics, indices, and exchange data in a secure and adaptable connection. Our data solutions span a wide range of asset categories, delivered securely to assist you in meeting your investing, trading, compliance, and risk management needs.

Credit Derivatives

SRCOM's over-the-counter (OTC) markets have had a significant impact in enhancing visibility, liquidity, and the ability to trade in markets that were previously obscure and not easily accessible. By combining its extensive experience in OTC markets with its credit knowledge, SRCOM has emerged as a top player in the fields of trade processing and risk management.

Driving Market Intelligence

Here at SRCOM, we identify opportunities, make well-informed decisions, and execute efficiently in the field of trade. We manage risk, assess the effectiveness of processes, and ensure compliance with regulations. We utilize advanced technology and integration tools to facilitate streamlined data management.

Trading

Our trading platforms are fundamental to who we are as a company and provide support for a wide range of financial instruments, including global equities, indices, options, futures, fixed income, forex, commodities, derivatives, cryptocurrencies, and structured products.

Global Trading Across a Broad Array of Asset Classes

Our platform allows for global trading across various types of assets, ensuring fair and efficient access to liquidity.

Connecting the Marketplace

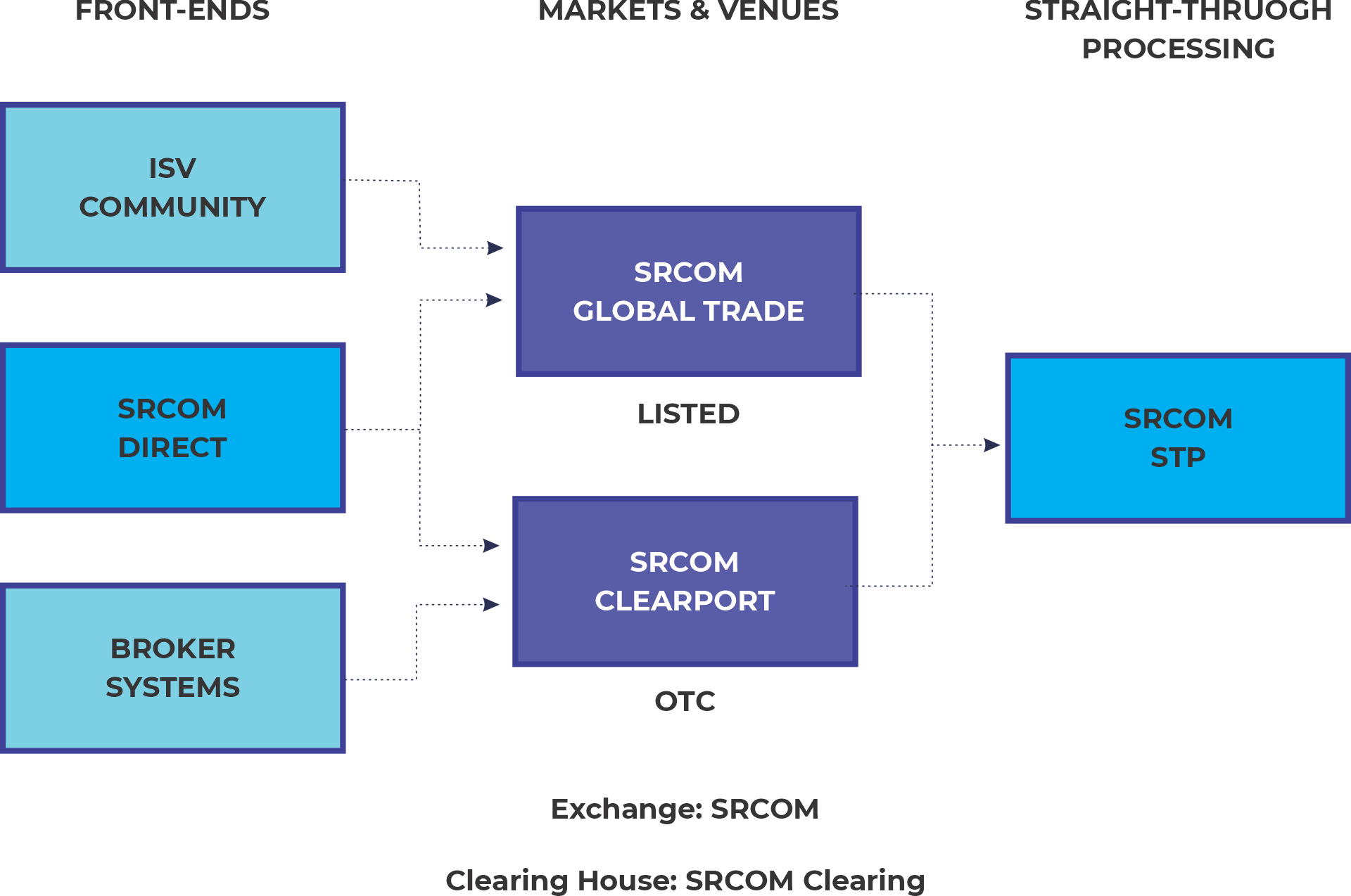

SRCOM enhances its current open-access model by offering a convenient and affordable platform to access and exchange all of SRCOM's products through a unified system provided by the exchange.

Trading and Execution

Making well-informed choices when trading based on available information.

Our front-office solutions provide exclusive cross-asset data and extensive insights to enhance your operations, allowing you to identify possibilities, act quickly, and maximize outcomes.

| SRCOM Connect | SRCOM Connect offers a unified platform that grants users access to trading, messaging, and analytics tools by leveraging single sign-on technology. |

| SRCOM Mobile | Stay in touch with our comprehensive technology solutions for trading, messaging, and data analysis. |

| Market Data | Customize the market intelligence and data you require with a wide range of pricing and analytics, indices, and exchange data options. |

| Trade | A system of secure and versatile technology enables a trading and app ecosystem, offering a centralized way to access SRCOM futures markets. |

| Evaluated Pricing | Pricing coverage, quality, independence, and delivery in fixed-income markets have been thoroughly assessed and established. |

| Continuous Evaluated Pricing | Real-time pricing for various asset classes such as corporate bonds, emerging markets, mortgages, and municipal bonds is accessed to improve pre-trade transparency and trading workflow. |

| Valuations | Pricing details and resources for various commodities, credit, equities, FX, and interest rates. |

| Excellent Execution Service | Assess and control the execution quality of bond trades while also ensuring compliance with regulatory requirements. |

| Bond Trader | Examine the assets, distributions, and achievements of portfolios consisting of fixed income and multiple asset classes. |

| SRCOM Connect | This platform combines live market information, charts, analysis, and news from around the world, enabling market participants to better handle price and currency risk. |

| SRCOM Data Derivatives | Comprehensive services for trading across different assets throughout the trading lifecycle. |

| SRCOM Liquidity | Assess the level of liquidity risk in your investment portfolio. |

| Commodity Indices | Created to offer a fluid, uniform, indicative, and economical standard for assessing the performance of commodity markets. |

| ETF Services | Utilize the comprehensive range of services provided by SRCOM Data Services, which includes support from the initial idea generation to index development and calculation. |

| Equity Indices | This index family supports ETPs, options, futures, structured products, and insurance products. |

| Fixed Income Indices | This content encompasses a wide range of indices, monitoring a staggering amount of debt, spanning across different currencies. |

| Index Customization | The strong ability to customize and the feature of automatically organizing raw materials can assist in the creation and management of customized indices that cater to specific investment strategies, like ETFs. |